Bitcoin (BTC) Leads Recovery After Black Friday Crash

Bitcoin (BTC) rose to a higher tier, invalidating some of the more catastrophic predictions. After its usual Black Friday price slump, BTC regained its position, bouncing from a low near $54,000 to above $57,000 at the start of the new trading week.

As BTC sets for the final stretch of 2021, the current valuations suggest new all-time highs are still viable based on predictive models. BTC traded at $57,310.43 on Monday, recovering trading volumes to above $29B in 24 hours. After a sluggish weekend, BTC settled its dominance to 42.1%.

Ethereum Projects Rush to Recovery

The market optimism did not only affect BTC. Ethereum (ETH) returned above the $4,300 tier, quickly followed by several tokens.

ETH traded at $4,321.11 entering the European trading hours on Monday. The token expects further breakouts against BTC and for now keeps its 20% market cap dominance.

The Ethereum network is getting a boost from the new fee schedule introduced in August. In each block, a small amount of ETH gets burned forever. On Monday, the network had burned 1,049,710 ETH, breaking a milestone of 1 million tokens burned.

An additional dent into the supply of ETH are tokens locked in the ETH 2.0 smart contract. While there is no set date on launching ETH 2.0, there are already more than 8.4M tokens locked, with a constant inflow of starter packages of 32 ETH.

ETH is also being taken off the market for decentralized liquidity pools and other projects requiring some locked coins as collateral.

Token-Based Projects Soar

The recent market crash did not erase all gains from the biggest movers in token-based projects. Play to earn tokens once again set on an expansion track. Decentraland (MANA), The Sandbox (SAND) and Gala Games (GALA) recovered and kept most of the gains from the past expansion cycle. SAND was one of the strongest performers in the pack, as it expects the alpha launch of its game metaverse.

SAND added another 26% in the past 24 hours, trading again above $7.51. The game project held a raffle for digital land owners, offering early access to experiences and world building. So far, the Sandbox game has built a demo version and only allows a limited number of creators to build digital items. Most digital land owners bought plots in expectation of the game launch, as a potential future investment.

LUNA Survived the Red Weekend

One of the big movers, which also survived the weekend, was Terra (LUNA). The asset traded at $49.13, close to its previous peaks above $50.

One of the reasons for the success of LUNA is the solid use case and the significant usage of its dollar-priced asset, UST. LUNA also gained recent mainstream media attention, expanding its influence as a potential pivotal project in the expanding crypto economy.

The total value locked on the Terra platform is estimated at $11.36B, about a tenth of the value of Ethereum (ETH). At this value, LUNA lines up as one of the more successful DeFi tokens, with the potential for additional NFT and gaming activity.

Overall, small-scale altcoins make up more than 20% of the cryptocurrency market, with additional share for the more influential projects.

BTC Correction was Less Severe

The latest price slump may be a short-term event linked to the long weekend for US-based traders. The latest crash of BTC from levels above $58,000 to $54,000 brought relatively small liquidations. On Monday, about $5.61M in BTC positions were liquidated, with only 30% longs liquidated on the Binance exchange.

Despite this, trading moods remain fearful, and the Bitcoin fear and greed index is around 33 points pointing to “fear”. The latest price moves once again put a question mark on the stock-to-flow model, a prediction that saw BTC rise to $100,000 by the end of the year.

The model allows for some short-term fluctuation before turning on track. Still, BTC seems to be lagging as the $60,000 level turned into resistance. So far, the model has held up, despite facing criticisms. At the more extreme, the S2F model sees BTC reach $135,000 by the end of the year.

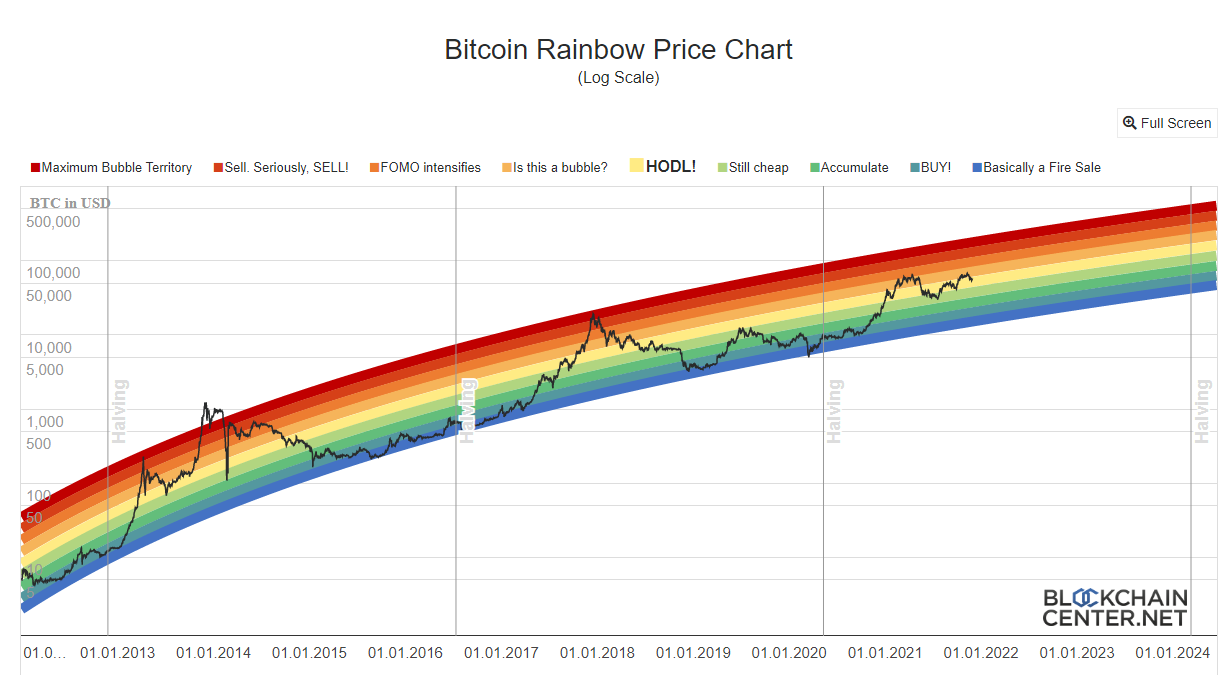

The current rainbow chart model, another predictive pathway for BTC, suggests the best strategy is to hold onto the assets. Unlike previous peak cycles, this time the BTC market price barely touched fears of a bubble forming. The recent all-time highs were also supported by large-scale corporate buying and more significant liquidity.

November’s correction wiped out about a fifth of BTC value since the peak around $68,000.

Additional data from Glassnode reveal the latest price dip was once again accompanied by whale buying, as BTC coin scarcity increased.

Additionally, there are some signs of retail buying as more BTC addresses with a small balance keep appearing.

With over 50 coins and an obsession with security, Kraken is one of the safest places to buy and trade crypto.

Kraken has a good reputation for security and protection of your funds and operates across the USA (except NY), Canada, the EU and Japan

Celebrities on social media can have huge followings creating enormous power to influence their followers. We look at who are the most influential and some of the potential risks of following their advice

How do cryptocurrencies stack up against popular stocks and shares?

The first cryptocurrency. It has limitations for transactions but it is still the most popular being secure, trusted and independent from banks and governments.

Solana is a cryptocurrency project with a radically different approach to how blockchains work. It focuses on an element which is very simple: time. It seems introducing a decentralised clock to a cryptocurrency blockchain makes it more efficient than anyone could have possibly imagined. Solana is a high-performance cryptocurrency blockchain which supports smart contracts and decentralised applications. It uses proof of stake consensus mechanism with a low barrier to entry along with timestamped transactions to maximise efficiency.