Is Bitcoin (BTC) Preparing for Another Slide

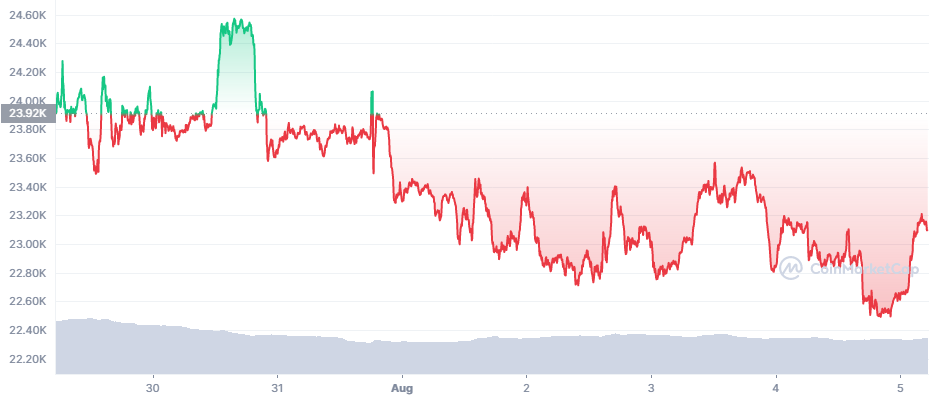

Bitcoin (BTC) had another day when the price slipped under the $23,000 range. At this price point, BTC saw predictions for a potential breakout, but also caution for consolidating and preparing for another downturn.

BTC has been relatively range-bound, unable to hold above $24,000 for long. Predictions of getting close to $30,000 this week did not materialize, instead sending BTC down to $22,618.06. For now, the deflation of the price is relatively slow, on the usual trading volumes of around $24B in 24 hours. Later, BTC recovered to $23,130.96.

The BTC market price looks weighed down, losing hundreds over the course of the day. The latest downturn caused higher liquidations, reaching $15.57M late on Thursday. BTC remains close to the 200 day moving average, still capable of reclaiming its historical trend.

Ethereum (ETH) also continued to dip, despite expectations of a possible trek to $2,000. ETH traded around $1,598.43.

BTC remains in consolidation as the supply of Tether (USDT) slightly increases, to 66.4B tokens. With those market conditions, some earnings are made with smaller altcoins and short-term rallies. The dominance of BTC has fallen to 40.9%, while Ethereum (ETH) also lost its influence down to 18.4% of the crypto market cap.

This time, however, the new USDT mint did not affect the markets immediately, and some of the new tokens may be waiting on the sidelines.

The 1B token mint was followed by transfers to the Binance exchange and other markets. USDT has lowered its supply from a peak of 83B, adding to the continuation of the bear market. However, each time, the market bottoms out with a higher supply of USDT, which is also widely involved into the trading ecosystem.

Is BTC Preparing for Another Slide

There are some signs that BTC is consolidating and the rally may not be immediate. The market is still in bearish territory, expected to extend until the end of 2022. One of the signs of more potential selling is a shift of more coins to exchanges in the past month.

BTC still closed July with a net gain, though going through lows under $19,000 briefly. Yet for the past three months, BTC is still down from the $36,000 highs that preceded the accelerated losses.

The BTC/USDT pair on Binance also has a slight advantage compared to the Coinbase price against the US dollar.

Will Accumulation Continue

Talk of new selling may bring down BTC prices further. For now, MicroStrategy has announced its readiness to hold onto its coins.

The selling may be a part of a more recent development, where traders may have bought in the spot market at $17,700 lows, to sell later when BTC broke to a higher range. Glassnode also keeps revealing small-scale retail purchases, creating new wallets with a minimal BTC balance.

While BTC remains more volatile than usual, this current price level remains close to the accumulation zone based on the Rainbow Chart model. Buying at a small scale and after a series of capitulations may be used as a less risky long-term bet, leaving years to wait for a new bull market.

At the same time, there are still sellers realizing losses, and the indicator has not shifted to a more bullish ratio.

BTC analysis shows around 53% of holders are in the money, which also includes early adopters and long-term buyers. 4% of the BTC have been bought and held at this current market price.

Altcoin Exceptions Still Happen

The recent downturn erased the gains for the list of tokens and coins that pumped in the past few days.

The latest dramatic price action comes from Flow (FLOW), which added 32% in a single day to reach a one-month high. This highly volatile pump may reverse just as fast, despite having a three-month peak in trading activity, with volumes above $609M.

Flow is a hub for the creation of distributed apps, offering open access to developers. The FLOW asset is present on both Binance and Coinbase, hence the potential for faster rallies. FLOW reached $2.53, with a significant part of the activity concentrated in the Binance trading pairs.

The last two weeks saw multiple tokens take their turn in rallying hard. The current bear market does not preclude pumps, though they are riskier than an overall bull altcoin market with appreciation across the board.

Previous peaking tokens, such as Ethereum Classic (ETC) are now back to the $34 range after maxing out above $43.

Tokens like Near Protocol (NEAR) preserved some of their recent gains to stand at $4.43. VeChain (VET) also holds onto $0.029 after this week’s rally.

With over 50 coins and an obsession with security, Kraken is one of the safest places to buy and trade crypto.

Kraken has a good reputation for security and protection of your funds and operates across the USA (except NY), Canada, the EU and Japan

What are the most common scam coins and how much have they got away with in the past, plus some tips on how to avoid these scam coins.

A review of the many options for crypto exchanges and what the main differences are

A multi-utility asset, linked to the diverse activities of the Binance Exchange. A token to pay trading fees, as well as participate in new asset sales, BNB now runs on a proprietary blockchain.

Solana is a cryptocurrency project with a radically different approach to how blockchains work. It focuses on an element which is very simple: time. It seems introducing a decentralised clock to a cryptocurrency blockchain makes it more efficient than anyone could have possibly imagined. Solana is a high-performance cryptocurrency blockchain which supports smart contracts and decentralised applications. It uses proof of stake consensus mechanism with a low barrier to entry along with timestamped transactions to maximise efficiency.