What Brought Bitcoin (BTC) Above $42,000

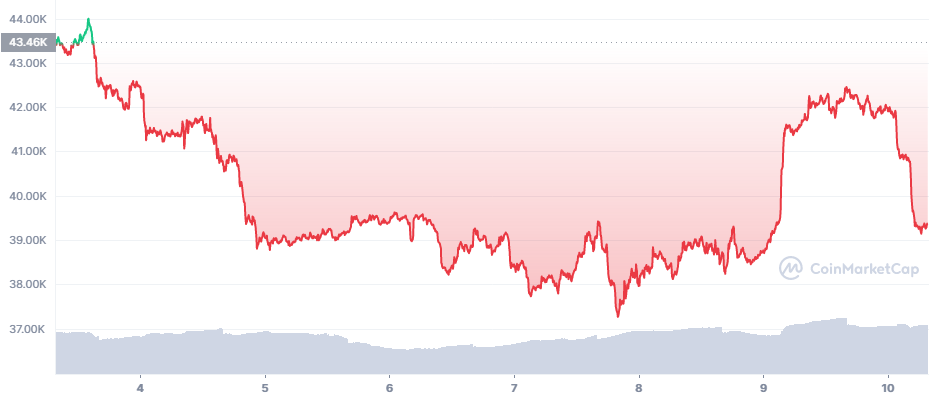

Bitcoin (BTC) had another day of rapid appreciation, rising above $42,200 within hours. Events like that are an outright attack on short positions, built around the expectations of a continued dip. The rally liquidated some of those short positions that expected the drop to continue without interruptions.

Total liquidations in the past 24 hours were above $188M equivalent, with $8M in BTC liquidations. Binance liquidations also affected long positions. The rally was short-lived, as about a day later BTC is back down to $39,221.89.

BTC Breakout Surprises Markets

In the past few days, the price moves of BTC followed the overall slide in stock markets. But the most recent price move was also considered a surprising pump. With sufficient stablecoins waiting on the sidelines, it is not difficult for both spot and derivative traders to move the price of BTC.

The question for BTC remains whether this price move is part of the trend to higher valuations, or a brief respite from a continued potential bear market.

BTC gave some short-term encouraging signs, with a higher low on a weekly time frame, possibly leading to another bullish trend.

Will BTC Face Further Restrictions

BTC rallied after US President Joe Biden revealed a softer stance on cryptocurrencies. Previously, expectations of the Executive Order predicted more significant restrictions.

So far, no effective bans against BTC have been achieved, despite having a handful of countries banning ownership. BTC remains one of the most accessible tools for value transfer, despite threatening sanctions.

The mix of factors may also be setting up BTC for a continued expansion, especially based on rising popularity and inflationary pressures.

Accumulation for BTC Continues

With less than 10% of all BTC left to be mined, the pace of accumulation is higher than new coin inflows. While illiquid supply can quickly turn highly liquid, the general trend sees more coins sitting out the latest price volatility, and eating into the available supply for trading.

Since BTC positions can be taken through stablecoins, the actual BTC can be kept away from exchanges. With no KYC, tracing those coins is more difficult, and they cannot be linked to an identity with ease.

At the same time, one of the biggest addresses for BTC, suspected to belong to MicroStrategy or another big “whale”, has added another 412 BTC, worth more than $15M. A few days earlier, about 1,500 BTC left the address for a possible sale, and more than 700 BTC flowed back in.

Now, the third-largest BTC address has a net 126,341.56 BTC balance, competing with the wallets of leading exchanges.

USDT Printing Preceded Rally

The most recent price rally coincided with another uptick in the supply of Tether (USDT), now rising to above 80B tokens. Around 300M USDT were injected in the past few days ahead of the BTC rally.

At the same time, the supply of USDC fell by 600M to 52.4B, while the asset still remained highly influential. The recent BTC rally happened with relatively mid-range volumes at $31B in 24 hours, while USDT and USDC activity spilled over for altcoins.

The latest appreciation lifted the dominance of BTC to 43.1%, once again achieving a faster expansion compared to Ethereum (ETH) and most altcoins. ETH managed to recover above $2,700, but has faced more headwinds in the past few weeks.

Terra (LUNA) Rallies Again

LUNA once again showed it moves based on a different logic. While BTC recovered strongly, the LUNA gains reached more than 22% at one point, sending the asset above $103. LUNA later retreated just under $100, with more than 16% in daily gains.

LUNA remains much more volatile and benefits from a significant percentage of locked coins. Demand for UST also lifts LUNA prices.

The success of LUNA also lifted NEAR Protocol, which moved back to $11.22, also gaining nearly 16%. NEAR Protocol adopted LUNA and UST as part of its network, expanding a thriving DeFi network.

WAVES Continues Rally

WAVES is on track to repeat previous highs, as the asset continued to rally on a daily basis. WAVES is now trading above $27, after gaining more than 22% overnight. For now, it is uncertain if altcoins rally based on fundamental factors, or if the pumps are just one-off events.

The recent Monero (XMR) rally stalled just above $200, as the asset returned to around $186. XMR is now yet to prove its rally signified growing demand, or was a short-term event.

At the same time, assets like XRP and Cardano (ADA) remain almost without movement, with interest shifting to DeFi tokens. Play-to-earn assets have also lost some of their previously hot appreciation, with most tokens sliding to lower levels as the blockchain games offered diminishing earnings.

With over 50 coins and an obsession with security, Kraken is one of the safest places to buy and trade crypto.

Kraken has a good reputation for security and protection of your funds and operates across the USA (except NY), Canada, the EU and Japan

What is bitcoin? Who controls it? Where can I buy it? Your questions answered!

Crypto investment remains unpredictable and risky, but good practices can save you from many of the potential pitfalls.

An innovative digital asset utilizing a fully decentralized consensus protocol called Ourobouros. The network aims to compete with Ethereum in offering smart contract functionalities. However it is lightyears behind Ethereum in terms of adoption.

Solana is a cryptocurrency project with a radically different approach to how blockchains work. It focuses on an element which is very simple: time. It seems introducing a decentralised clock to a cryptocurrency blockchain makes it more efficient than anyone could have possibly imagined. Solana is a high-performance cryptocurrency blockchain which supports smart contracts and decentralised applications. It uses proof of stake consensus mechanism with a low barrier to entry along with timestamped transactions to maximise efficiency.