Market Crash Boosted HEX After Trading Anomaly

HEX, a long-term fixture in the world of cryptocurrency, is making waves again. After a confusing glitch on CoinMarketCap, where Ethereum turned into a number-one coin, the assets saw their order rearranged.

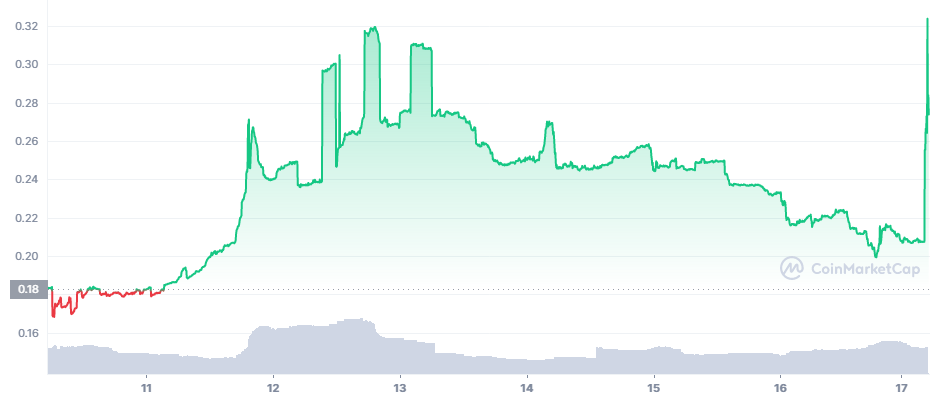

HEX, a low per-unit price token, suddenly climbed to $0.25 and seemingly had a supply shock, which sent it to position 8 in terms of market capitalization. Data showed 173B out of a total 653B HEX have entered the market, giving the project a capitalization of above $168B.

Within an hour, HEX had managed to swing more than 32%, shooting up to a new price range. HEX is still far from its absolute record above $0.50, but has returned to its old volatility after a period of relative quiet.

Why is HEX Rising

The most probable answer is that the price move is an anomaly or a deliberate pump. HEX prices have made similar moves in the past, and the project is big on self-promotion.

The rise proved to be very short-lived, and probably a reporting anomaly, as HEX returned to position 201 based on its market capitalization.

HEX is a high-yield staking platform, which has been viewed with suspicion in the past as a potential scam. The HEX market price is highly volatile, often erasing a significant part of its value.

The proposition of HEX is simple – buy the token, lock it in for a period of time and receive a high interest rate. The project claims 200,000 active wallets, and has managed to survive most attacks against its reputation. However, HEX is viewed with some skepticism in the crypto community.

HEX Founder Opens New Staking Mechanism

HEX is not the only high-yield platform built by Richart Heart. The next project aims to be a fork of Ethereum with a different fee burning schedule. Pulse Network, as the project is called, has existed as a testnet since the end of September.

At this point, the final date for Pulse Network remains unknown.

Why HEX Trades Unpredictably

One of the reasons for the relatively low liquidity of HEX and the highly volatile price is the limited exchange profile of the token. The price discovery of HEX happens mostly on the Uniswap decentralized exchange, and this may allow for price anomaly reporting.

Uniswap is also less liquid and highly volatile, with total HEX volumes around $6M in 24 hours, in pairings with USDC and ETH. The recent price volatility for other assets may be causing problems with Uniswap price formation. HEX hovered around $0.21 on Uniswap after erasing some of the recent gains.

Markets Extend Overall Price Drop

The HEX anomaly coincided with an overall market price drop. Bitcoin (BTC) slid to $59,443.55, threatening to break down from the positive trend in November. The two highly successful weeks where BTC twice recovered its all-time high are in the past, and now BTC is again at a crossroads of choosing direction.

Altcoins slid further, once again shedding nearly 10% of their value. The market was pressured after the signing of the US Infrastructure Bill, which may increase scrutiny on US persons and businesses involved with cryptocurrency.

Is There Still Optimism Left

The Bitcoin sentiment crashed to 52 points on the Bitcoin fear and greed index, from 71 points on Monday. However, there are still signs of whale activity, continuing to mop up BTC from the market.

The recent rally happened with significantly lower exchange reserves for BTC, and a growing scarcity of actual coins. Signs of whale buying at the lower price range continue to be caught by on-chain data.

The recent crash, however, allows for a bigger dip, possibly revisiting the $50,000 to $53,000 range. BTC has yet to face the month-end futures expiration event, where bulls and bears aim to protect their positions on the last Friday of the month. After that, BTC and altcoins will have to face the final stretch of 2021, still far from the most dramatically bullish predictions.

Why Avalanche (AVAX) is Rising Despite Market Crash

The cryptocurrency market remains unpredictable, and some assets are having a field day. AVAX rose close to the $100 range, moving against the overall trend. AVAX remains one of the fastest-growing DeFi protocols.

In the past day, AVAX touched an all-time high of $101.86, before sinking toward $97. The token may be used as a safe haven as Ethereum (ETH) erased more value and is now sinking closer to $4,000.

The other winner was Crypto.com coin (CRO), which is up above $0.45 and in pure price discovery range with new all-time highs in the past week.

With over 50 coins and an obsession with security, Kraken is one of the safest places to buy and trade crypto.

Kraken has a good reputation for security and protection of your funds and operates across the USA (except NY), Canada, the EU and Japan

A roundup of the main exchanges in Australia allow you to quickly buy Bitcoin and other crypto on your card

The basics of cryptocurrency portfolios and how to get started in tracking your crypto holdings

The leader in programmable money, smart contracts and decentralised applications. There have been many copycats but none have the community and level of adoption.

This is a specific digital coin running on a series of servers. XRP promises utility in handling cross-border transactions to compete with the SWIFT interbank payment system. Being controlled by banks, many question if it is a true cryptocurrency.