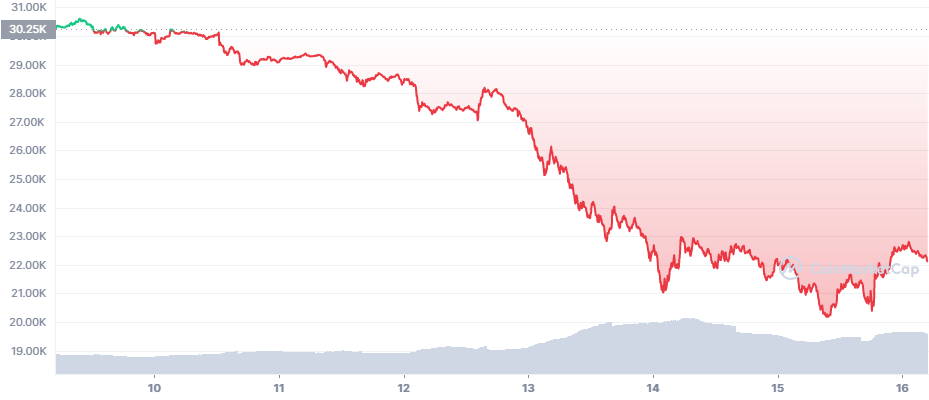

Bitcoin (BTC) Extends Crash on DeFi Loan Liquidations

The effect of Terra LFG continues, after it affected the balance of Celsius. The current price slide uncovered previously non-transparent and difficult to trace connections between projects. It turned out the multiple passive income funds and deposit facilities relied on decentralized loans. The biggest flaw of those loans is that their collateral can be liquidated if Bitcoin (BTC) and Ethereum (ETH) fall under a predetermined price.

Currently, Celsius blockchain data show enough deposits to ensure against a BTC price drop as low as $15,000. With BTC rising to $22,284.31, the immediate danger of liqudation diminshed. But there is no way to predict a continued price drop.

ETH Slide Triggers Additional Liquidations

Beyond Celsius, there are also indications of another crypto hedge fund having its collateralized DeFi loans liquidated. On-chain data intercepted several large liquidation events possibly belonging to the 3AC fund.

The 3AC fund used the AAVE decentralized protocol, one of the earliest DeFi hubs. However, the rapid drop of ETH under $1,050 managed to liquidate some of the ETH collaterals of 3AC.

AAVE holdings crashed to $5.08B in notional value, down from a peak above $18B. The problem is that funds hold valuable crypto assets on behalf of retail buyers, which also earn interest on their deposits. As it turns out, the lack of liquidity and the essentially inaccessible funds is leaving Celsius depositors without their BTC or other assets.

The recent losses only amplified the message of holding BTC only on a wallet where the owner controls the private keys and can move the coins at any moment. Unfortunately, Celsius worked in a somewhat misguiding manner, promising access to funds at any time. Just days before its crash, Celsius reassured holders of their liquidity.

Unlike exchange losses, the funds work with much more assets under management. The value erased by Terra LFG was around $44B. Celsius reported more than $28B in assets under management at the peak. Other DeFi protocols and blockchains held more than $30B in value.

Is BTC in a Bull Trap

BTC looks relatively cheap, especially compared to its peak above $69,000. But the recent turbulence raises questions of more potential unraveling in collateralized lending.

The recent price recovery is also viewed as a temporary relief, only to extend the crash with a short-term prediction of $18,000.

The Crypto Fear and Greed Index is at an all-time low down to 7 points. The market has other signs of panic, including Coinbase and other projects once again laying off parts of their workforce. However, there are also signs of continued accumulation, expecting a recovery with a long-term horizon.

Fed Meeting Addded to Market Slide

BTC now crashes along with stocks, ahead of the next US Fed meeting. There are expectations the price of BTC did not discount the upcoming rate hike, which is expected to be the biggest in 28 years.

The US Fed voted to raise interest rates in one go by 0.75 percentage points, a rapid move to hawkish monetary policy after more than a decade of near-zero rates. Due to its rapid rise, BTC still outperformed traditional assets and tech stocks, which have also been in freefall since the end of 2021.

The crypto market now prepares for what looks like a recession with tightening monetary policy for the dollar and the euro.

Falling ETH Price Hurts DeFi

ETH is now threatening to go below $1,000, with multiple effects for DeFi projects. The total value locked in DeFi is dramatically down to $39B, unwinding a larger set of loans and protocols that at one point held above $110B. After the rapid crash, however, ETH recovered above $1,200.

The ETH-based DeFi is still the biggest collection of funds remaining, especially after the depreciation of Solana (SOL), Binance Coin (BNB) and Avalanche (AVAX).

The ETH market now braces for prices under $1,000 in the near future, with a possible dip to $500.

The longer-term prediction is that the current crypto winter would continue to develop at least until the end of 2022. More lows are expected this year, with extreme predictions seeing BTC under $10,000 and ETH at $500 or lower.

One of the problems for ETH is exposure to Staked ETH, a derivative token that can go illiquid.

DeFi protocols may see their holdings devalued due to exposure to stETH. The Staked ETH product cannot be exchanged for ETH until 6-12 months after the ETH 2.0 merge. There is also very real potential for more delays of ETH 2.0, further creating problems for protocols like Curve Finance. The stETH price is now just 94% of the market price of liquid ETH tokens.

The Staked ETH product is provided by Lido Finance, to grant liquidity to more than 12M tokens staked in the ETH 2.0 smart contract. While stETH is issued on a 1:1 basis, its price can fluctuate as it has to be swapped on the secondary market.

Uphold makes buying crypto with popular currencies like USD, EUR and GBP very simple with its convenient options to swap between crypto, fiat, equities, and precious metals.

With over 50 coins and an obsession with security, Kraken is one of the safest places to buy and trade crypto.

Kraken has a good reputation for security and protection of your funds and operates across the USA (except NY), Canada, the EU and Japan

Based in Charleston, South Carolina. Serves over 184 countries and has done over $4 billion in transactions. Offers convenient options to swap between crypto, fiat, equities, and precious metals.

In Part 3 we look at more advanced trading strategies including flags, false breakouts and the rejection strategy

How do cryptocurrencies stack up against popular stocks and shares?

The leader in programmable money, smart contracts and decentralised applications. There have been many copycats but none have the community and level of adoption.

Solana is a cryptocurrency project with a radically different approach to how blockchains work. It focuses on an element which is very simple: time. It seems introducing a decentralised clock to a cryptocurrency blockchain makes it more efficient than anyone could have possibly imagined. Solana is a high-performance cryptocurrency blockchain which supports smart contracts and decentralised applications. It uses proof of stake consensus mechanism with a low barrier to entry along with timestamped transactions to maximise efficiency.